Board of Directors

The board of directors (Board) is the top management and highest decision-making body of the Company. Its duties and functions include: appoint and supervise the Company’s senior management, supervise operational performance, prevent conflicts of interest and assure the Company’s legal compliance, establish the articles of incorporation or carry out resolutions made by the general meeting of shareholders, and maximize the rights and interests of shareholders. Currently, the Board holds at least one board meeting each quarter for management to report operational performance. The Board also resolves the future operational direction and important policies of the Company. Two functional committees, Compensation Committee and Audit Committee, are established under the Board. Both committees report their resolutions to the Board for deliberation. Through the review of functional committees, the Board is facilitated to carry out its duties to increase the interest of shareholders. The Board is formed with nine directors, including three independent directors, of different professional backgrounds. The diversified expertise of directors covering finance, law, and industry benefits the Company’s decision-making and long-term strategy planning for operations. To strengthen the sustainable development framework, the Board established the Sustainable Development Committee and passed the articles of organization in June 2022. This is a milestone set by the Company’s highest governance body to ingrain “sustainable development.

Duties of the Board

- Draw up the Company’s operational plan.

- Prepare the annual financial report and biannual financial report.

- Establish and revise the internal control system.

- Establish the procedures for handling important financial activities, including the acquisition and disposal of assets, engagement in derivatives trading, loans for others, and making endorsements or guarantees for others.

Board Members

-

-

Major education attainments and experience

- Department of International Business, Feng Chia University.

- Vice President, Sanhosun Industry.

-

Concurrent duties at the Company or in other companies

- Chairperson, Jeng-Yi Business Management Consultant Co., Ltd.

-

Major education attainments and experience

-

-

Major education attainments and experience

- Chairman of the Board, SuperAlloy Industrial Co. Ltd.

- Department of Chemical Engineering, United Technology and Business School

-

Concurrent duties at the Company or in other companies

- President, PVI Chemical Co., Ltd.

- President, Chia-yi Investment Co., Ltd.

-

Major education attainments and experience

-

-

Major education attainments and experience

- Judge, Chief Prosecutor, Presiding Judge, Minister of Justice, the Republic of China.

- LLB, National Taiwan University

-

Concurrent duties at the Company or in other companies

- President, SAI Fu-de Social Welfare Foundation

- Independent Director, Century Wind Power Co., Ltd

- Visiting Professor, National Chung Hsing University

- Honorary Chair Professor, Finance and Economic Law, Asia University

-

Major education attainments and experience

-

-

Major education attainments and experience

- Junior Manager, Hua Nan Bank

- Department of International Business, Feng Chia University

-

Concurrent duties at the Company or in other companies

- N.A.

-

Major education attainments and experience

-

-

Major education attainments and experience

- Assistant Manager, Taiwan Business Bank Co., Ltd.

- Public Service Special Examination

-

Concurrent duties at the Company or in other companies

- Director of SuperAlloy Industrial Co. Ltd.

-

Major education attainments and experience

-

-

Major education attainments and experience

- Section Manager, Accounting, Sanhosun Industry

- National Open University

-

Concurrent duties at the Company or in other companies

- Director of SuperAlloy Industrial Co. Ltd.

- Section Manager, Accounting, Sanhosun Industry

-

Major education attainments and experience

-

-

Major education attainments and experience

- President, National Cheng Chi University.

- Ph.D. in Accounting, University of Missouri, USA.

-

Concurrent duties at the Company or in other companies

- Independent Director, Hanns Touch Holdings Company

- Independent Director, Acepodia

- Adjunct Research Chair Professor, Department of Accounting, Chengchi University

-

Major education attainments and experience

-

-

Major education attainments and experience

- Professor, College of Agriculture and Natural Resources, National Chung Hsing University

- Ph.D. in Agriculture Economics, National Taiwan University

-

Concurrent duties at the Company or in other companies

- Lifetime Distinguished Professor, College of Agriculture and Natural Resources, National Chung Hsing University

- Member of Advisory Committee, Ministry of Environment, the Republic of China

-

Major education attainments and experience

-

-

Major education attainments and experience

- Professor, School of Law, Soochow University

- Ph.D. in Law, Westfälische Wilhelms-Universität Münster

-

Concurrent duties at the Company or in other companies

- Independent Director, Celxpert Energy Corporation

- Distinguished Professor, School of Law, Soochow University

-

Major education attainments and experience

-

-

Major education attainments and experience

- Vice President, China Bills Finance Corporation

- Department of Finance, National Chung Hsing University

-

Concurrent duties at the Company or in other companies

- N.A.

-

Major education attainments and experience

Board members are aged between 40 and 80 years.

Audit Committee

The Audit Committee was established in 2017 to strengthen corporate governance. The Audit Committee is formed with at least three independent directors and holds least one committee board meeting each quarter or extraordinary committee meetings as necessary. Please refer to the Company’s annual report or MOPS for information regarding the number of committee meetings held. The Audit Committee audits:

- Establishment and revision of the internal control system.

- Evaluation of the effectiveness of internal control system.

- Establishment or revision of the procedures for handling important financial activities, including the acquisition and disposal of assets, engagement in derivatives trading, loans for others, and making endorsements or guarantees for others.

- Matters relating to the personal interest of directors.

- Transactions of important assets and derivatives.

- Important loan, endorsement, or guarantee matters.

- Fundraising and the issuance or private placement of share-based securities.

- Appointment, dismissal, or remuneration of CPAs.

- Appointment and dismissal of the chief financial officer, chief accounting officer, and chief internal auditor.

- Preparation of the annual financial report and biannual financial report.

- Other important matters requested by the Company or competent authorities.

Compensation Committee

The Company established the Compensation Committee by resolution of the Board and appointed the committee members in 2011 to strengthen corporate governance. The Compensation Committee is formed with three independent directors and holds at least two committee meetings each year. Please refer to the Company’s annual report or MOPS for information regarding the number of committee meetings held. The Compensation Committee evaluates the salary and compensation policy and system for directors and officers and makes recommendations for the Board for the reference of decision-making.

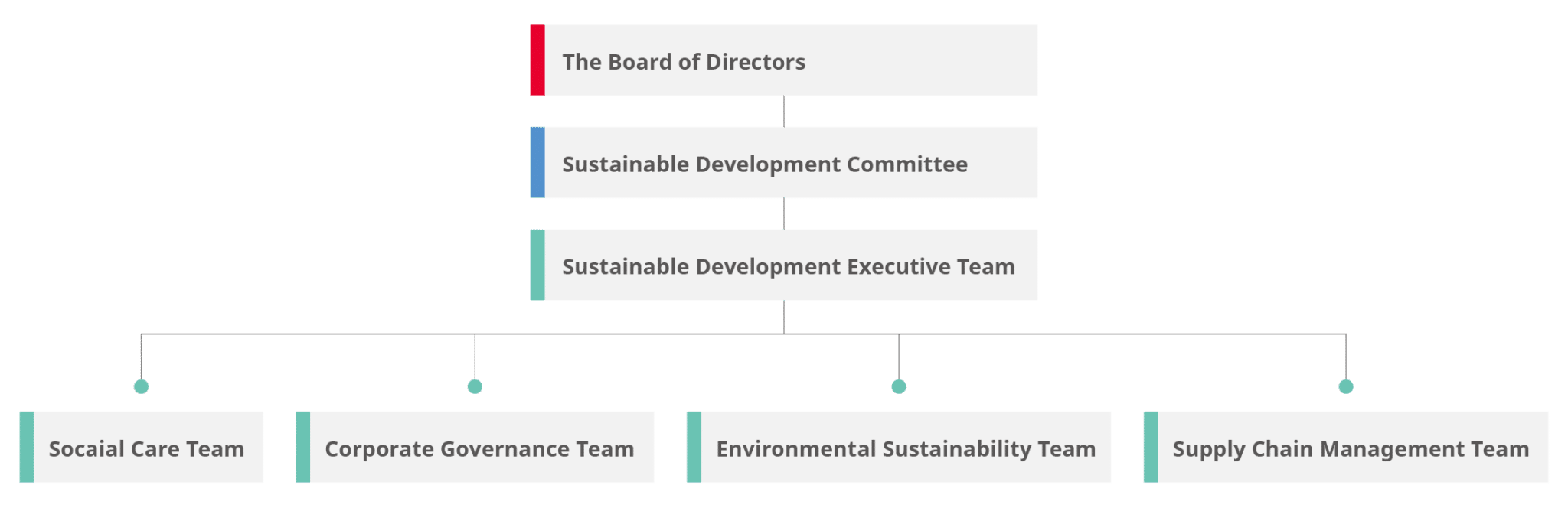

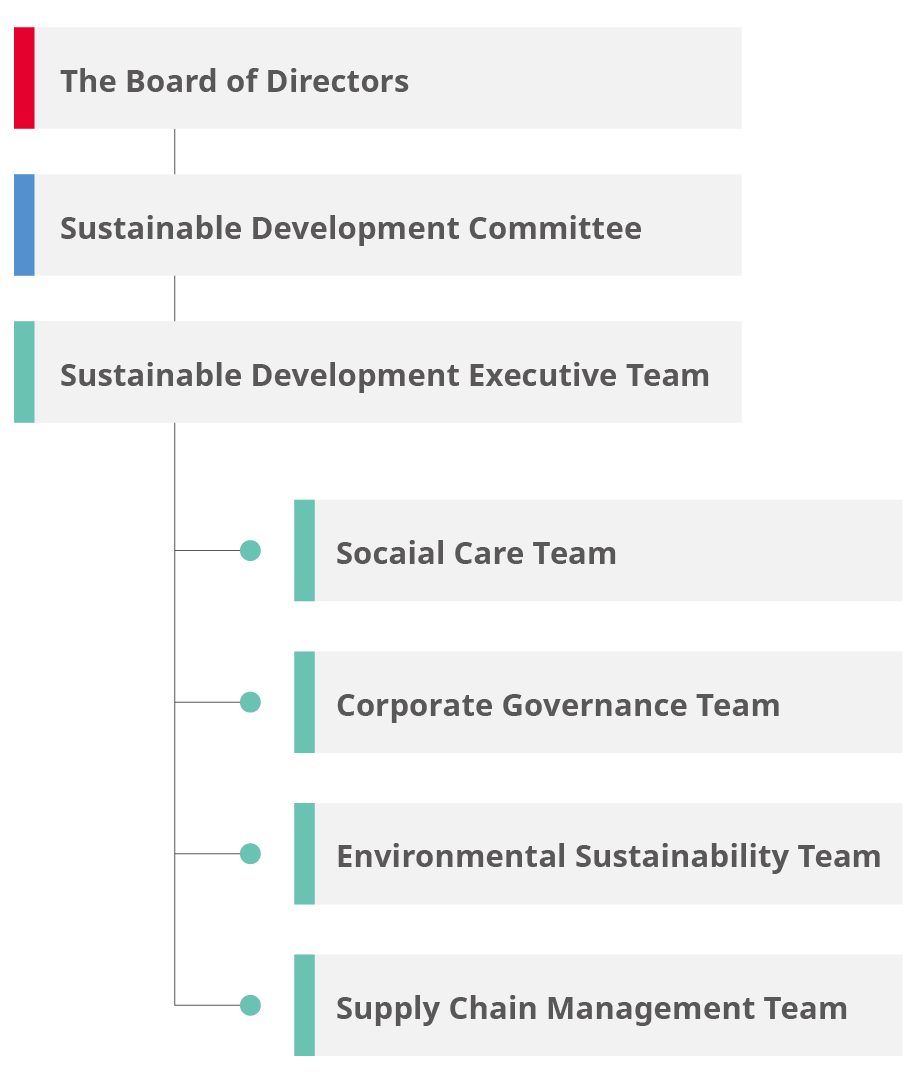

Sustainable Development Committee

SAI has established a Sustainable Development Committee, with the Chairman serving as the Convener and appointing the deputy convener. The purpose is to ensure that major work decisions on corporate social responsibility and sustainable development can be implemented and to strengthen the company’s operating system. We are actively committed to the three major areas of environmental conservation (E), social responsibility (S) and corporate governance (G) to ensure that the Board of Directors can effectively fulfill its responsibilities and protect the rights and interests of the Company, Employees, Shareholders and Stakeholders. In order to effectively promote these tasks, the committee has established four functional teams, Corporate Governance Team, Environmental Sustainability Team, Social Care Team and Supply Chain Management Team. Each team is convened by the head of relevant department, who is responsible for supervising the operation, participating in team meetings, and assisting members in implementing every projects.

Internal Audit

The internal audit function is an unbiased, independent unit directly under the Board. It attends the meetings of the Audit Committee and the Board to present audit reports. Apart from reporting the audit progress and results to the members of the Audit Committee each month, the internal audit unit also reports to the routine Board meeting.

Duties and functions of internal audit

The duty of the Audit Office is to investigate and evaluate the internal control system and the suitability of operation, effectiveness, and efficiency and make timely recommendations for improvements to ensure that the internal control system is continuously and effectively implemented. The Audit Office also assists the Board and management in carrying out their duties.

Operation of internal audit

An internal audit system is planned and designed in accordance with the internal control system of individual departments. Based on this internal audit system, the internal control of each process is reviewed, and the suitability of the design, practice, effectiveness, and efficiency of such control is reported. In accordance with regulatory requirements, an internal audit shall be implemented each year to review the self-inspection of the internal control system of individual departments. The scope of audit covers the internal control of the effectiveness and efficiency of operations, the reliability of financial statements, compliance with the relevant laws and regulations, and others, as well as assessment of the risk level of operations of individual departments. Based on the audit outcomes, the Audit Office will plan the audit program for the next year and implement the audit with Board approval.

Procedures for self-inspection of internal control

Apart from the audit description, indication of materiality levels, and proposition of recommendations, responsible units will be requested to submit an action plan with an estimated date of improvement completion in the audit report. After the due date of improvement completion, the improvement results will be traced with reference to the action plan. The internal audit department is staffed with one full-time chief auditor and two to three auditors. The scope of audit covers all operating processes of the nine transaction cycles, and the audited units include the Company and all subsidiaries.

Stakeholders

For different stakeholders, SAI has set up special communication channels to accept and respond to the needs of stakeholders.

Employees / Supplier

Gary Huang

+886-5-551-2288 #748

gary.huang@superalloy.tw

Customers

Stephen Tseng

+886-5-551-2288 #646

stephen.tseng@superalloy.tw

Investors

Spokesperson: Felicia Hsiao

+886-5-551-2288 #102

Acting Spokesperson: Kelly Wang

+886-5-551-2288 #204

info@superalloy.tw

Important Regulations Download

- Articles of incorporation

- Rules governing the Conduct of Shareholders' Meetings

- The procedures for the Election of Directors

- Rules and Procedures of Board of Directors Meetings

- Rules of Audit Committee

- Remuneration Committee Charter

- Regulations of Sustainable Development Committee

- Management of Assets

- Management of Endorsement and Guarantees

- Management of Loans to Others

- Procedures for Preventing Insider Trading

- Performance Evaluation of Board of Directors

- Corporate Social Responsibility Best Practice Principles

- Corporate Governance Best Practice Principles

- Ethical Corporate Management Best Practice Principles

- Information Security Policy (REV.005 2025/12)

- Anti-Brivery & Anti-Corruption Policy

- Human Right, Gender Equality, Diversity & Inclusion

- Anti-Salvery and Human Trafficking Statement

- Direction of Prevention and Management of Unlawful Infringement in the Performance of Duties

- Code of Conduct